Do you remember that little thrill you felt when a dividend payment landed in your account? That's the beauty of dividend investing - regular income flows into your account while you sleep, work, or enjoy life.

That feels great...until you realize you've lost track of which companies paid what, when to expect the next payment, or how your dividend income affects your tax situation.

The cost of not tracking dividends goes beyond disorganization. Without proper dividend tracking, you're flying blind with your investment strategy. You might be missing growth opportunities, making poor reinvestment decisions, or leaving money on the table at tax time.

In this guide, you'll discover why dividend tracking is essential for serious investors and how to select the right tools to do it well.

Let's turn your investments into a wealth-building machine!

Before we start: What are dividends?

When companies pay dividends to shareholders, they're sharing profits in the form of cash payments. But dividends are not always guaranteed! Firstly, the board of directors must approve each quarterly or annual dividend. Secondly, the company's dividend amount can fluctuate based on the company's cash flow and balance sheet strength.

As dividend investors know, a stock's dividend yield may seem attractive, but the dividend payout ratio often tells a more complete story. Companies with a history of dividend payments and consistently growing their dividends tend to provide investors with both steady income and long-term growth. That helps build wealth more effectively than those focusing solely on earnings for growth.

Table of Contents

- How to Find Dividend Payers? Essential Tools for Dividend Investing

- Firstly, Use Dividend Stock Screeners For Individual Investors

- JustETF

- Dividend.com

- MarketBeat

- Secondly, Check Deep Research Resources

- Seeking Alpha – Dividend Grades

- Morningstar – Dividend Analysis

- Thirdly, Integrate Discovery with Your Strategy

- What You're Losing When You Don't Track Your Payouts?

- Ok, So What You Gain When You Track Them Properly?

- 1. Master-Level Control Over Your Portfolio

- 2. Tax Optimization: Keep More of What You Earn

- 3. Financial Planning: Building Your Income Stream

- Easiest Way to Monitor Dividends? Dividend Tracker

- Comprehensive Reporting & Analysis

- Dividend Calendar & Forecasting

- Data Integration & Export Options

- Now Multiply the Benefits of Dividend Investing!

- Key Takeaways

- Your Next Steps

How to Find Dividend Payers? Essential Tools for Dividend Investing

Finding quality dividend stocks is often the most challenging part of the story. Before you can track and optimize your dividend income, first, you need to discover companies that consistently pay dividends and match your investment criteria.

While you could manually research thousands of companies to find them, the tools below can do that for you. In minutes instead of hours. They filter through market data to help you identify companies that:

- Have established dividend payment histories

- Maintain sustainable payout ratios

- Show potential for dividend growth

- Match your specific investment criteria

Remember that dividends are paid quarterly or annually, so staying organized is essential 😉

Firstly, Use Dividend Stock Screeners For Individual Investors

They are like search engines that filter the market based on criteria you choose. They help you narrow down thousands of stocks to a manageable list of your potential investments, allowing you to filter stocks by:

- Current dividend yield

- Dividend growth rate

- Payment history length

- High payout ratio

- Industry sector

Check the options below and add some of them to your toolkit 👇

JustETF

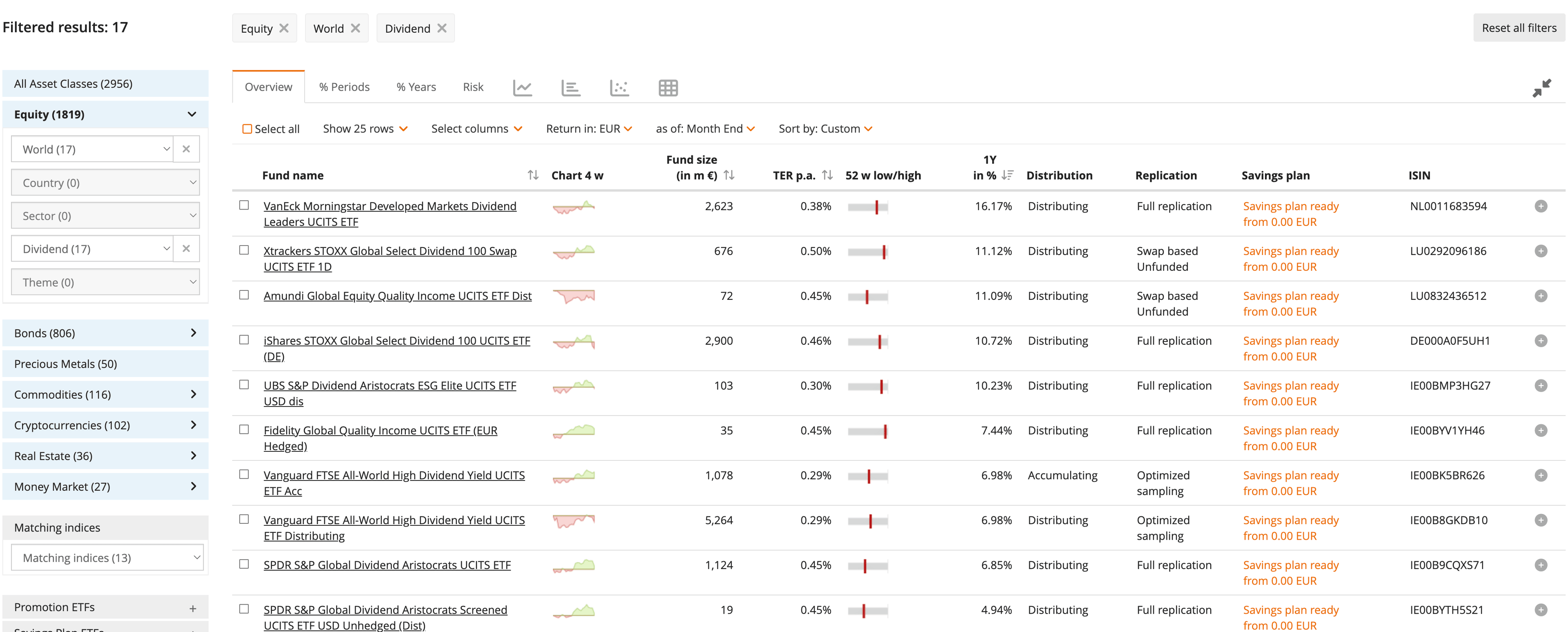

JustETF offers an excellent screener focused on dividend ETFs, allowing you to filter by:

- Dividend yield

- Dividend growth history

- Geographic focus

- Sector concentration

- Fee structure

Why use JustETF

If you prefer lower-risk dividend investing through diversified ETFs rather than individual stocks, JustETF helps you find funds that match your exact criteria while providing built-in diversification. This reduces your company-specific risk while still giving you access to steady dividend income.

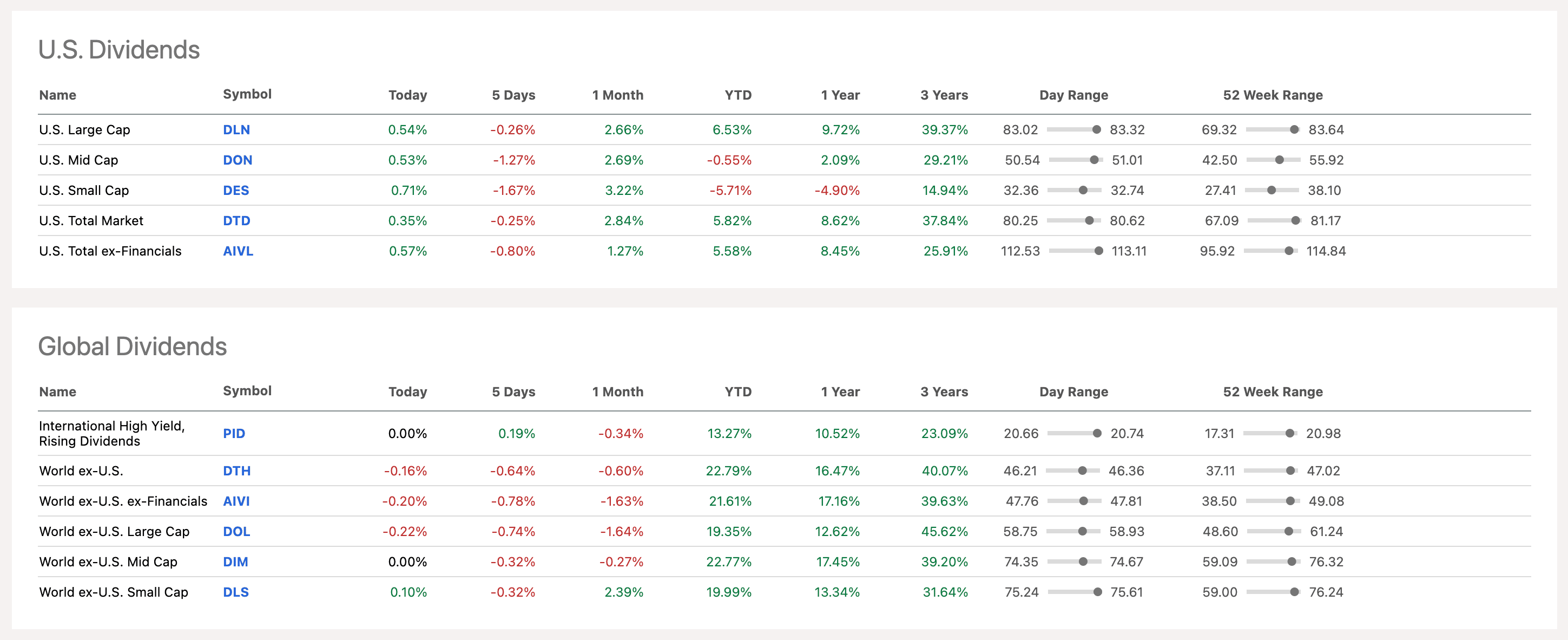

Dividend.com

A resource dedicated to dividend investing that provides:

- DARS™ ratings (Dividend Advantage Rating System)

- Dividend safety scores

- Payout ratio analysis

- Dividend growth history

- Upcoming ex-dividend dates

Why use Dividend.com

Thanks to their proprietary Dividend Safety Scores and payout ratio analysis, you can identify stocks that not only offer a higher dividend yield but are likely to maintain and grow those payments over time. Their exclusive reports on dividend aristocrats (companies with 25+ years of consecutive dividend increases) help you find the most reliable dividend payers in the market.

MarketBeat

MarketBeat offers a user-friendly interface with powerful filtering options like:

- Dividend yield ranges

- Market capitalization

- Sector/industry

- Dividend payment frequency

- Dividend growth rates

Why use MarketBeat

Their interface makes it easy to easily find stocks that match your dividend criteria, while their alerts for upcoming dividend payments and recent increases help you stay ahead of market movements. This allows you to purchase stocks before a company announces the dividend or identify companies showing growing dividend trend.

Secondly, Check Deep Research Resources

Have you already identified potential dividend stocks through screeners? Now use these research tools to evaluate their quality before investing:

Seeking Alpha – Dividend Grades

Seeking Alpha assigns letter grades to dividend stocks across multiple dimensions:

- Dividend Safety

- Dividend Growth

- Dividend Yield

- Dividend Consistency

Why use Seeking Alpha

Their grading system helps you quickly assess dividend quality across several critical factors. By combining quantitative metrics with qualitative analysis, you get a more complete picture of a dividend stock's true value and sustainability and avoid traps (stocks with unsustainably high yields). Keep in mind that stock price fluctuations can affect your future dividend returns, so their analysis helps balance growth and income potential.

Morningstar – Dividend Analysis

Morningstar's in-depth research includes:

- Economic moat assessments (competitive advantages)

- Stewardship ratings (management quality)

- Fair value estimates

- Dividend coverage analysis

Why use Morningstar

Their unique economic moat and stewardship ratings help investors identify companies with sustainable competitive advantages and quality management, two factors critical for long-term dividend growth. Their fair value estimates also help ensure you're not overpaying for dividend stocks, maximizing your yield on cost and total return potential.

Thirdly, Integrate Discovery with Your Strategy

Use these tools in combination:

- Start with screeners to identify potential dividend stocks matching your criteria

- Use research tools to evaluate the quality and sustainability of those dividends

- Create a watchlist of high-quality dividend stocks

- Monitor for optimal entry points or ex-dividend dates

- Once invested, systematically track your dividend income

This approach helps you build a dividend portfolio based on data-driven decisions rather than hunches. Companies that pay dividends tend to be more established businesses with proven cash flows. This makes them a reliable way for investors to earn both income and potential appreciation.

Remember that dividend stocks are subject to market risks just like any investment!

Many investors choose dividend reinvestment to compound their returns over time, but you must own shares before the ex-dividend date to receive the dividend. While stocks may underperform during certain market conditions, dividends are often more stable than stock prices, providing a cushion during market downturns - especially when paid to shareholders by companies with strong fundamentals and a history of increasing payouts.

By combining growth investing principles with income strategies, you can build a portfolio that gives you enjoyable income through various market cycles.

What You're Losing When You Don't Track Your Payouts?

Why some investors consistently outperform the market while others struggle to make any progress? The difference often comes down to how they track their portfolios.

Without proper tracking, you're exposing yourself to several risks:

- Missing dividend payments that didn't arrive as expected

- Tax inefficiencies from improper planning and documentation

- Poor reinvestment decisions due to a lack of performance data

- Difficulty forecasting your future passive income streams

Let's face it: dividend investing without tracking is like driving cross-country without a map - you might eventually reach your destination, but you'll waste time and resources along the way. Whether you use received dividends to boost income or to purchase additional shares for your investment portfolio, proper tracking is essential. Especially since qualified dividends are taxed differently than ordinary income.

Moreover, monitoring dividend history for stocks held not only helps with taxes but also provides insight into which dividend stocks can provide the most reliable returns over time.

Ok, So What You Gain When You Track Them Properly?

1. Master-Level Control Over Your Portfolio

When you track your dividends meticulously, you gain great visibility into your portfolio's performance. You can identify which individual stocks are your workhorses and which are underperforming. This allows you to make decisions about:

- Which positions to maintain or increase based on their dividend per share growth

- Which dividend-paying stocks should be exited when they fail to increase dividends

- How are your cash dividends diversified across sectors and companies

2. Tax Optimization: Keep More of What You Earn

Because dividends are payments made by companies to shareholders in the form of cash, they come with tax implications that vary based on:

- Qualified vs. non-qualified dividends

- Your tax bracket

- Investment account types (taxable vs. tax-advantaged)

Without proper tracking, you might be paying more in taxes than necessary. A good tracking system should help you:

- Separate different forms of dividends for tax purposes

- Plan strategic moves between taxable and tax-advantaged accounts

- Document everything needed for accurate tax reporting

3. Financial Planning: Building Your Income Stream

Perhaps the best benefit of dividend tracking is the ability to forecast and plan your future earnings. This becomes even more important as you:

- Approach retirement and need regular dividend payments as a reliable income stream

- Set financial independence goals based on your total annual dividend income

- Make decisions about reinvesting vs. taking income from high dividend yields

By understanding your dividend growth rates, payment schedules, and current dividend yield versus average dividend yield, you can project your future income with great accuracy.

Easiest Way to Monitor Dividends? Dividend Tracker

The difference between casual collecting and strategic investing in dividend stocks often comes down to how seriously you take the tracking process. As the payments made by companies to you grow, so does the importance of having systems in place to monitor and optimize this becomes crucial.

The difference between casual dividend collecting and strategic dividend investing often comes down to the systems you use to track, analyze, and optimize your income streams.

This is where tools called dividend trackers come on the stage. But not all of them are created equal. A truly effective tracker should simplify the import process for your transaction history from brokerage accounts and identify and categorize different types of income streams.

A good tracker should balance both manual input and automated tracking, which helps maintain accuracy while reducing the tedious aspects of portfolio management.

Manual or Automated Input?

Manual transaction entry actually provides an advantage in some cases, giving you more control and verification over your financial data compared to fully automated systems that might miss nuances in your specific situation.

Comprehensive Reporting & Analysis

Data without insights is just numbers on a screen. Your dividend tracker should transform raw payment data into actionable intelligence through:

- Dividend yield calculations that show actual performance versus expectations

- Yield on cost metrics that reveal the true return on your original investment

- Sector allocation analysis to ensure proper diversification of income sources

- Growth trend visualization to identify which holdings are increasing their payouts over time

The best dividend tracking software provides both high-level overviews and the ability to drill down into specific holdings for deep analysis.

Dividend Calendar & Forecasting

Dividend investing becomes easier and more enjoyable when you know what's coming. Look for tools that offer:

- Payment schedule calendars showing when to expect income throughout the year

- Forward-looking projections based on current holdings and historical growth rates

- "What-if" scenario modeling to explore portfolio changes

- Visualization of dividend patterns to identify seasonal income fluctuations

Some tools may even offer more advanced features, but the calendar and forecasting are the core that help you plan future income without worries.

Data Integration & Export Options

Your dividend tracker doesn't exist in isolation within your financial ecosystem. Consider how it handles data movement:

- Import from multiple sources to consolidate information from different brokerage accounts

- Export functionality for creating custom reports, tax documentation, or sharing information with advisors

- Data formats compatible with tax preparation workflows to simplify year-end reporting

- Comprehensive data access that allows you to use your information how and where you need it

Rather than expecting direct software integrations (which are rare in this category), focus on how easily you can move your dividend data in and out of the system.

Choosing the right tool depends on your needs as a dividend investor. Are you primarily focused on dividend tracking, or do you need a whole portfolio management solution? Do you value customization over automation? Privacy over cloud accessibility?

Consider these key factors when comparing dividend tracking apps: 🤔

- Dividend-specific features

- Overall portfolio management capabilities

- Data privacy and security

- Pricing structure

- Ease of use and learning curve

Looking for the High-Fidelity Dividend Tracker?

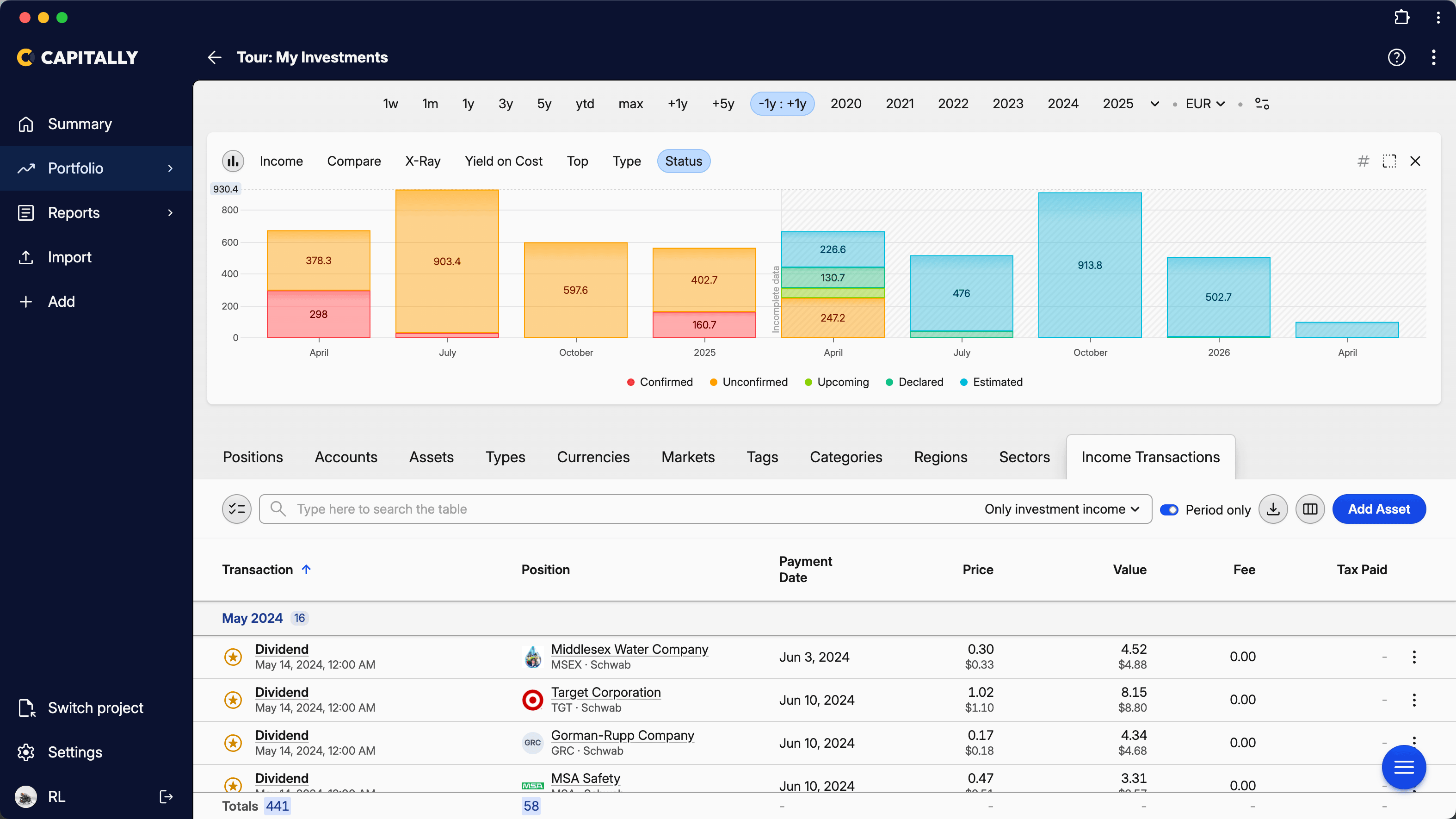

If you're serious about tracking and optimizing your dividend income - consider Capitally.

What makes Capitally different:

- Smart dividend handling: After importing your transactions, Capitally helps track dividends, splits, and market prices

- See all key dividend-specific metrics: Dividend Yield, Yield on Cost, Dividend Growth rates, and payment frequency patterns

- Visual dividend calendar: See upcoming dividends and estimate future income streams

- DRIP support: Calculate the compounding effect of dividend reinvestment plans

- Multi-currency support: Track international dividend stocks with currency conversion

- On-device encryption: Your financial data remains safe and accessible only to you. Never touched by us or any third parties

If this resonates with you, see Capitally's dividend tracking capabilities and give it try with free trial!

Now Multiply the Benefits of Dividend Investing!

Now you know why tracking dividends is essential if you want to optimize your returns and build wealth.

Key Takeaways

- Proper dividend tracking provides visibility into your passive income streams, helping you make informed decisions rather than guessing.

- Tax optimization becomes possible only when you have complete records of your dividend income, types, and sources. It saves you thousands in unnecessary tax payments.

- Future financial planning becomes concrete and actionable when you can accurately project your dividend income.

- The right dividend tracking tool makes all the difference between struggling with scattered information and having a clear, comprehensive view of your income.

- Complementary research tools help you discover new dividend opportunities that can be seamlessly integrated into your tracking system.

Your Next Steps

These in-depth comparisons between Capitally and other popular trackers will help you choose the best tool for you:

- Review of Best Dividend Trackers

- Capitally vs Snowball Analytics

- Capitally vs Sharesight

- Capitally vs getquin

- Capitally vs. Excel

Once you have read them and decided that our approach speaks to you, I encourage you to explore Capitally's dividend features to see how it can elevate your investment strategy.

Good luck with your investments!